Sunday, 02 February 2025 10:03

Impact of tariffs on Canada - economic consequences and consumer effects

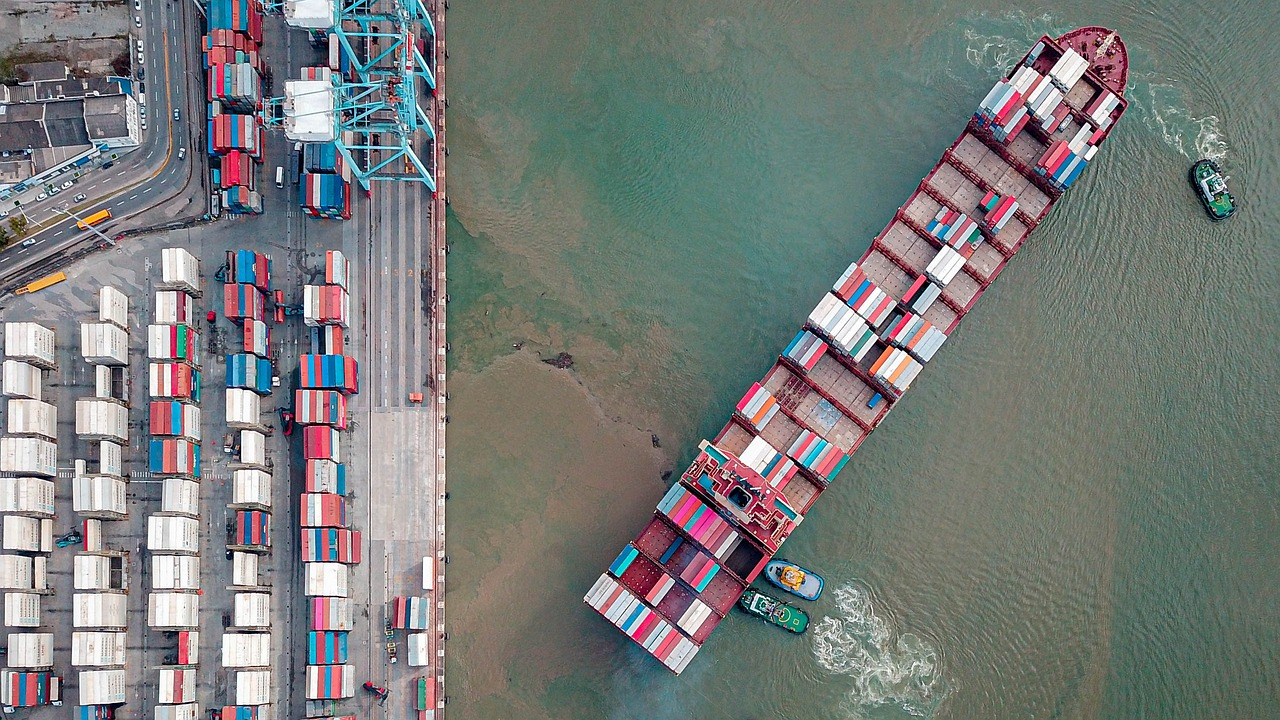

The issue of tariffs has gained significant attention in Canada following months of warnings from U.S. President Donald Trump. Tariffs can have major economic consequences for businesses and consumers in both Canada and the United States. Experts predict higher prices and potential economic downturns if trade barriers remain in place.

Sunday, 02 February 2025 09:26

Canada imposes retaliatory tariffs after U.S. trade restrictions

Thursday, 23 January 2025 18:09

Trump’s statements on Canadian exports raise trade concerns

During a video address at the World Economic Forum in Davos, Donald Trump questioned the need for U.S. reliance on Canadian imports. His remarks included the possibility of imposing 25 percent tariffs on Canadian oil, gas, autos, and lumber. These statements have sparked concern about potential economic impacts on both countries.

Friday, 03 January 2025 17:14

Ontario residents to receive $200 rebate by early 2025

Tuesday, 17 December 2024 13:24

Even as more Canadians choose to spend their holidays north of the border, many are also paying close attention to

Even as more Canadians choose to spend their holidays north of the border, many are also paying close attention to Canada continues to be a top choice for individuals seeking a high quality of life and robust career opportunities. With

Canada continues to be a top choice for individuals seeking a high quality of life and robust career opportunities. With Entering a new market can be challenging without local expertise, but https://ewl.com.pl/en/ lights the way by offering expertise in workforce

Entering a new market can be challenging without local expertise, but https://ewl.com.pl/en/ lights the way by offering expertise in workforce